Submitted by Laura Fay – Approved October 21, 2024

Continue reading Eliot Neighborhood Association Board Meeting Minutes Monday 9/16/2024

Submitted by Laura Fay – Approved October 21, 2024

Continue reading Eliot Neighborhood Association Board Meeting Minutes Monday 9/16/2024

Today- Monday 10/21/2024

7:00 – 8:30 pm

Cascadia Garlington Health Center

3036 NE Martin Luther King, Jr. Blvd

Using Microsoft Teams for the meeting:

Click here to join the meeting

Co-Chairs: Jimmy Wilson and Patricia Montgomery

Agenda (subject to changes):

Next meeting Monday, November 18, 2024

Free legal help will be available at from noon to 4pm on Friday, October 18 at Cascadia Health! You may qualify for help with criminal or eviction record expungement, charge reduction, driver’s license reinstatement and waiving traffic or criminal fines, lifting warrants, and small business business and legal advice.

Pre-registration is not required but highly encouraged to be sure you are seen. Please pre-register by Thursday, October 17 at this link: http://bit.ly/communitylawintake

A recent study by the Federal Reserve found that the average (“median”) price of a home is $350,000 and that a new home costs $440,000 ($100,000 of this for the land). Homeownership rates have been around 65% since the 1950s. The same report found that 77% of people could not afford a $350,000 home. Simply put, about half the people who want to buy (and can qualify to do so) are priced out of the market, including mostly younger people looking for their first home. To meet that demand, homes need to be priced around $250,000. That is a huge gap and a looming political challenge to the status quo because of the belief that homeownership is essential for family wealth. This article explores three related elements of this issue: construction costs, policies to reduce them, and the myth of homeownership and wealth creation.

Although the first topic is the cost of “homes,” apartments face the same challenges, albeit at an average construction cost of $250,000. There are two components of current home prices: construction costs and supply/demand dynamics in the resale market. Costs of homes for sale are tied to new construction costs, because one is a substitute for the other.

New home costs have five major elements: land, labor, materials, capital (to build and buy), and government fees and mandates (i.e., insulation, trees, runoff, etc.). Each one of these has unique cost drivers and business requirements, so ALL need to be addressed to reduce costs. That is impossible. First, landowners, laborers, and material suppliers won’t voluntarily lower their prices. Second, capital costs follow the lead of the Federal Reserve which focuses on the entire economy, not just housing. That leaves government fees and mandates as the most likely cost control lever.

Government charges are 10-20% of construction costs. Efficiency, “green,” and other mandates add somewhat to material costs as well. If all government requirements and fees were eliminated it may just offset land costs and still leave the price of a new home at $340,000. This is still unaffordable to the majority of people who are trying to buy a home. It is also unrealistic to expect the government to do so.

The other factor in home prices is supply/demand balance. At present, supply and demand are NOT balanced, in part because Boomers are holding on to their homes longer due to high replacement home costs and interest rates and the high cost of new homes. The “political” solution has two planks: “build more,” and “expanding beyond the city.” Neither will work. Building more will increase demand for land, materials, and labor, which will INCREASE costs. This is basic economics! Worse, the “expansion” strategy encourages new home buyers (who are wealthier) to leave the city for new suburbs leaving urban areas to their current struggles. We have seen this movie before; it’s called Redlining.

The term “redlining” literally comes from a red line the federal government used in the 1930s to map areas it determined were too risky for banks to lend in. These were mostly inner-city neighborhoods usually with minority populations. Redlining 2.0 resulted from the post-WWII housing boom and construction of new suburbs. This housing boom was fueled by favorable government policies and financing programs for returning veterans, mostly white GIs. Its legacy was that major cities lost their middle- and upper-class residents to new suburbs. This left the remaining poorer residents to foot the bill for repairing, replacing, and maintaining century old infrastructure. It also imposed a huge burden on government institutions to deal with new fiscal realities of high costs and lower revenues. Adding insult to injury, urban residents were also paying taxes to support construction of new roads, bridges, and schools for these suburbs!

This will, of course, be the same outcome from Oregon Governor’s growth boundary expansion strategy as new urban infrastructure will be needed to support expansion of housing in the suburbs: this is Redlining 3.0. This is evident in Eliot as increased pressure to widen I-5 and replace the Interstate Bridge to support suburban travelers and delivery of their online purchases.

This brings us to the “homes are wealth” myth. Prior to WWII only 45% of the population owned a home and they were mostly on farms and in rural areas. Urban dwellers rented. The war transformed America from a rural to an industrial and urban power. Suburbs opened the door to homeownership, which soared to 65% of the population. As noted, most of these new homes were subsidized with low-cost GI Bill loans and other government funds for civic infrastructure (using taxes collected from all taxpayers).

Demand for new housing and home prices rose steadily from the md-1950s until Y2K. That trend supported the “homeownership for wealth creation” myth used by developers, realtors, and bankers to sell homes. Which increased demand and steady home price increases until the 2008 “housing crisis.” Recall, the housing crisis wiped out almost 10% of homeowners. They lost wealth, a lot of it! Nevertheless, home prices rebounded, and prices increased at an even faster rate. However, this trend masked significant home price declines in the Rust Belt and some old economy (textiles, shoe making, etc.) cities as well as in many rural areas. Imagine yourself as a homeowner in these areas! Selling your home at a loss or worse, losing it to the bank! That would be enough to turn you against the government and ripe for anti-urban elites claims of the MAGA movement.

To recap, housing is too expensive for as many as half of new buyers, mostly first-time buyers. “Building more” will make the problem worse by increasing demand for labor and materials already in short supply. “Expanding” outward will further erode tax revenues for urban areas and will subsidize new suburban dwellers sprawling onto farm and habitat lands.

What is a would-be homebuyer to do? And what can governments do that will actually help them?

First, recognize that “homeownership to build wealth” is a myth. Millions of homeowners have lost money. While millions have profited, most break even at best, after factoring in inflation and interest on their mortgage. A return of $0 isn’t “wealth creation.” To illustrate using the “average” case. The “average” home price in 1953 (oldest data available) was $214,000 in “today’s” inflation adjusted terms. In 2024, 70 years later, an “average” home would be worth $404,000. If that initial 10% down payment ($21,400, inflation adjusted) had been invested in the stock market, it would now be worth nearly $3 million! More importantly, that return is for just the original down payment. A mortgage is a recurring payment that also requires annual payment of taxes, insurance, utilities, maintenance and periodic major repairs. When those costs are deducted ownership is a loser for the “average” homeowner.

There are reasons to own a home, such as having a fixed housing cost, location, and dwelling size. Thanks to the legacy of Redlining, you may be able to choose neighbors who look like yourself (self-segregation). However, ownership can be a liability if you are forced to sell in a hurry to relocate or get divorced. The same is true if can’t afford increasing taxes or don’t like your neighbors or increased noise and crime. But what is the alternative – renting.

Realtors and bankers warn rents are high and landlords are greedy! Historically, home prices have increased 6.6% annually, whereas rent increases are half that, 3.3%. It’s true a fixed rate mortgage is more stable than rent, but tenants have the flexibility to move to lower their rent, change neighbors, change unit size, etc. Changes that are difficult for homeowners, and in the current home market economically prohibitive. Historically, renters have fewer choices of neighborhoods due to restrictive zoning laws. However, that has changed with the abolition of single-family zoning, the rise of ADUs and other novel housing options. Renters tend to be more transient; however, new rental “communities” offer amenities like adjacent grocery stores and onsite fitness and other facilities to retain residents and enable car-free living. This appeals to a younger generation that wants housing options that are both flexible and have a sense of permanence, be an affordable home or stable rental community.

What does this mean for government policy, especially if homeownership rates are likely to fall as both population and home prices grow? First, governments need to recognize we/they can’t “build” or “expand” our way into “housing affordability.” Housing is going to cost what it costs and that means it won’t be “affordable” to most people. The second is to recognize persistently high home prices means a growing share of the population won’t become homeowners. Homeownership enjoys a variety of subsidies, mostly tax based. This could be justified if 65% of the population owned a home. Homeowner subsidies may become an intergenerational flash point if that isn’t the case in the future. Policy makers should eliminate, rather than expand incentives for home ownership in favor of a housing neutral “affordability” payment available to both homeowners and renters based on need. A low to middle income family would get a similar, income-based, payment to assist with either rent or mortgage: their choice. Such a payment would give residents an equal voice to developers, realtors, bankers and more importantly, legislators.

this post was originally intended for the Eliot News newspaper

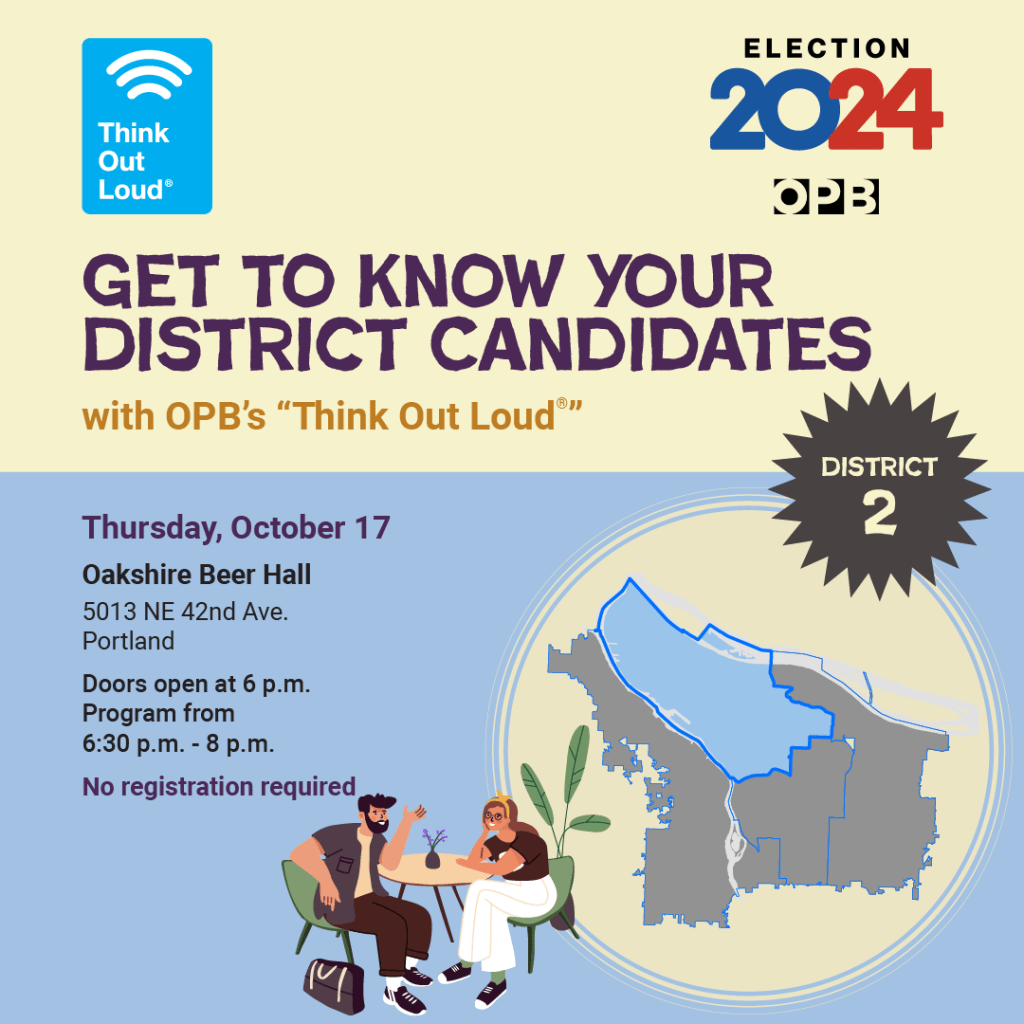

Ahead of this November’s election, OPB is arranging candidate forums for Portland’s new city council district. District 2 is Eliot’s district, and their forum will be held on Thursday, October 17, at the Oakshire Beer Hall in Cully.

No registration is required, but if you would like to submit questions to pose to the candidates, then please fill out this survey.

Let’s show up for Eliot and learn more about the candidates we will be voting for in November!

Join us on Stanton Street for family-friendly snacks and crafting on Saturday, October 19 from 10am-2pm!

Meet your neighbors and make spooky or cute things to take home. We’ll have mini pumpkins available, and if you’d like to decorate a big one please bring one with you! We plan to keep it simple with a focus on surface decorations rather than cutting through the pumpkins. Hope to see you there!

2-hour parking limits in evenings, October to May, except for residents and employees with new Zone V permits

New signs posted in the Eliot neighborhood, a few blocks north of the Rose Quarter, display 2-hour parking limits, from 5 to 10 p.m., October to May. The signs show drivers where Zone V parking permits are required for parking for more than two hours, allowing residents and businesses to park for longer and visitors to park for shorter periods. Photo by Portland Bureau of Transportation (PBOT).

(Oct. 1, 2024) Today, the Portland Bureau of Transportation (PBOT), in partnership with Eliot area residents and businesses, launched a new parking permit area—designated as “Zone V”—to discourage people attending large events in the Rose Quarter from parking in the nearby Eliot neighborhood.

Starting today, parking on the street in the new permit area will be limited to two hours between 5-10 p.m. for all those without a Zone V parking permit. The permit area includes the block faces shown in thick, blue bars on the map below. These new parking restrictions will be in effect every evening from October through May. Permits are available to eligible residents and their guests. Eligible businesses, nonprofits, and employees that need to park for more than two hours for work during the parking restrictions may also apply for Zone V parking permits.

This new program seeks to discourage people going to events in the Rose Quarter from parking in the Eliot neighborhood, freeing up spaces to make it easier for residents and their guests to find parking.

“Neighbors have been struggling with Moda Center event parking since it was called the Rose Garden,” said Allan Rudwick, Eliot Neighborhood Association Land Use & Transportation Chair. “For so many years, residents have been unable to have guests come over due to block after block being full of eventgoers. Some residents schedule their grocery outings around the games. Event attendees park at 6:30 p.m. or earlier and leave after residents go to bed. People coming home from work have nowhere to park within five blocks of their home. We are excited that parking management may solve these issues.”

This map shows on-street parking spaces where the new permits apply and properties where residents and businesses are eligible for permits. Map by PBOT.

Eliot residents have sought a solution here since at least 1992. The Eliot Neighborhood Association asked PBOT to look at parking issues in the neighborhood again after the Lloyd Event District was created in September 2022. After working with a task force composed of area residents and businesses to create a new parking permit area, Portland City Council unanimously approved the permit area June 12, 2024.

Parking permits for residents and employees cost $80 annually, with discounted rates based on median family income. Eligible households and businesses can apply for a free annual guest permit and up to 30 free daily guest permits in the first year. Eligible households and businesses have the option to purchase up to 70 additional daily guest permits.

People attending events in the Rose Quarter are encouraged to use public transportation, park in off-street parking facilities near the event venues, or park in the Lloyd Event District.

For more information:

See the Zone V parking permit area website Portland.gov/EliotParking

For questions about the permit application process or the online permit system, contact the PBOT parking permit team at 503-823-2777 or PBOTParkingPermits@porlandoregon.gov

For questions about the planning process, contact the PBOT parking district staff at PBOTParkingDistricts@portlandoregon.gov